No matter what you’re selling, chances are high that someone else is offering a similar — possibly even the same — product or service.

So, how can you effectively deal with your competitors and gain an edge over them?

The answer is competitive analysis.

Learn how to empower your company through a competitive analysis and set your product up for success.

What Is a Competitive Analysis and What Is Its Purpose?

A competitive analysis is a strategic tactic used to identify and evaluate competitors. The purpose of a competitor analysis is to determine the competitor’s strengths and weaknesses relative to your own product.

The main objectives of a competitive analysis are to:

Study the market scenery.

Predict market demand and supply.

Reformulate your business strategy.

Forecast market trends and patterns.

Recognize opportunities.

Acknowledge threats.

Calculate your competitor’s next move.

Redefine your company objectives.

“If all you're trying to do is essentially the same thing as your rivals, then it's unlikely that you'll be very successful.”

— Michael Porter

By learning what your competitors are doing and how they are doing it, you can take necessary measures to improve your company’s performance and differentiate yourself from rival companies.

How Do You Conduct a Competitive Analysis?

1. Create a List of Your Competitors

The first step is to identify your competitors. Now, you might think this is an easy feat, but it’s actually quite complex.

Sure, you might know one or two companies that you consider competition, but this is not enough to complete a competitive analysis.

Try to find at least 10 competitors with the help of:

Search engines. Simply running your company name in a search engine will automatically generate suggestions of businesses that offer the same or a similar product.

Search engine ads. Similar to search engine suggestions, search engine ads show paid ads from companies who are targeting the same market as you.

Prospects and customers. Learn about your competitors directly from the source. Ask your prospects and customers about any other businesses they’ve come by or used in the past.

Social media channels and forums. Look out for any mentions of competitors on social media and people discussing their products or services on discussion boards.

After you find at least 10 competitors, categorize them into two groups:

Direct, or primary, competitors. These are the companies that offer the same product or service as you, in the same location, and target the same audience.

For example, let’s say you sell bread. Any other bakery that also sells bread — in the same location, to the same consumer group, and at a similar price — is a direct competitor. The same goes for all sorts of other market niches, including brewing. Having a handle on primary competitors is at the core of setting beer prices wisely, and new arrivals need to be especially savvy about this in order to compete with incumbent brands that have the same target audience.

Indirect, or secondary, competitors. These are the companies that offer a different product or service but target the same audience and solve the same problem differently.

Using the example above, an indirect competitor would be another bakery that sells pies, cinnamon rolls, and cakes, as opposed to just bread. Though the products are different, the purpose and target audience is the same

Both types of competitors are equally important for successfully carrying out your competitive analysis.

2. Create Criteria for Comparison

The next step is creating criteria for comparison. What is it that you want to compare? Here are features you should focus on in the analysis:

Price. What pricing structures do competitors have in place?

Quality. What do users have to say about the quality of the product or service?

Customer service. How do they build and maintain relationships with customers?

Hours of operation. When are they up and running for business?

Employees. How many employees do they have?

Resources. What resources do they offer customers for a better experience?

Marketing. What does their marketing strategy look like?

Usability. Do they have a functional and practical UX design?

Design. Does the company website have a clear, intuitive design?

Sales. How much profit do they generate on a monthly/quarterly/yearly basis?

Elaborate on any or all of these variables when creating your criteria for comparison.

3. Select a Competitive Analysis Framework

One competitive analysis framework that’s an absolute hit among successful companies is a SWOT analysis. Basically, SWOT looks at four different sets of data about your competitors:

Strengths. What do your competitors do really well that differentiates them?

Weaknesses. What do customers complain about the most, and what products do they lack?

Opportunities. Have your competitors made any changes to their product that you can utilize?

Threats. Have your competitors made any changes that could have a negative impact on you?

To make the most of this competitive analysis tool, you need to collect enough data to satisfy all four areas. When you do, you can start brainstorming ideas to improve your current business practices.

4. Analyze Your Competitors

Once you’ve found your main competitors, set your criteria, and chosen your competitive analysis framework, you can finally begin running your competitive analysis.

Analyze each competitor against your list of criteria, and answer all the questions relevant to refining your company processes. Use the SWOT tool to create a template that will ensure that you stay on track and organize your data accordingly.

When you’ve gathered enough information about your competitors, put all the data together and see exactly where your company stands in comparison to competitors.

5. Identify Areas for Improvement

At first, you might find your findings a bit overwhelming. This is okay. Things will be much clearer once you start sorting through the data. Categorize your findings in a way that is easy for you to reference, such as by competitor or feature.

“Becoming number one is easier than remaining number one.”

— Bill Bradley

Take all the information and identify areas for improvement. Namely, what changes can you make or what innovations can you introduce to improve your company?

Perhaps you can redesign your landing pages, change your pricing structure, or look for ways to polish up your customer experience?

Don’t be afraid to challenge yourself and ask crucial questions that will help you make better decisions for your company.

Deeper Dive into Competitive Analysis Frameworks

Competitive analysis provides a structured approach to assessing an industry's competitive dynamics and identifying opportunities and threats. Businesses can make informed strategic decisions to gain a competitive advantage by carefully analyzing the competitive forces at play.

In the following sections, we will consider various frameworks that can be employed to conduct a comprehensive competitive analysis.

Porter's Five Forces: A Strategic Lens

Porter's Five Forces is a renowned framework that offers a systematic approach to analyzing an industry's competitive landscape.

Businesses can examine these five key forces to gain insights into industry attractiveness and identify potential threats and opportunities.

The Five Forces:

1. Threat of New Entrants:

Barriers to Entry: Factors that hinder new competitors from entering the market, such as high capital requirements, strong brand loyalty, government regulations, or economies of scale.

Example: The automotive industry has high barriers to entry due to significant capital investments in manufacturing facilities, research and development, and supply chain infrastructure.

2. Bargaining Power of Suppliers:

Supplier Influence: The ability of suppliers to influence industry profitability by raising prices, reducing quality, or limiting supply.

Example: In the pharmaceutical industry, a few key suppliers of active pharmaceutical ingredients (APIs) can exert significant bargaining power due to their specialized knowledge and limited competition.

3. Bargaining Power of Buyers:

Buyer Influence: The ability of buyers to negotiate favorable terms, such as lower prices or higher quality, by leveraging their buying power.

Example: Large retailers like Walmart and Amazon have significant bargaining power over their suppliers, enabling them to demand lower prices and stricter delivery terms.

4. Threat of Substitute Products or Services:

Substitute Pressure: The potential for alternative products or services to erode demand for an industry's offerings.

Example: The threat of video streaming services like Netflix and Hulu has significantly impacted the traditional cable TV industry.

5. Rivalry Among Existing Competitors:

Competitive Intensity: The degree of competition among existing firms in an industry. Factors such as industry growth rate, product differentiation, and switching costs influence the intensity of rivalry.

Example: The fast-food industry is known for intense rivalry among major chains like McDonald's, Burger King, and KFC, leading to frequent price wars and promotional campaigns.

Applying Porter's Five Forces

By analyzing these five forces, businesses can:

Assess Industry Attractiveness: Determine whether an industry is worth entering or investing in.

Identify Competitive Advantages: Identify areas where a firm can differentiate itself from competitors and gain a competitive edge.

Develop Effective Strategies: Formulate strategies to mitigate threats and capitalize on opportunities.

Make Informed Decisions: Support decision-making on pricing, product development, and market entry.

By understanding the dynamics of an industry, businesses can position themselves strategically to achieve sustainable success.

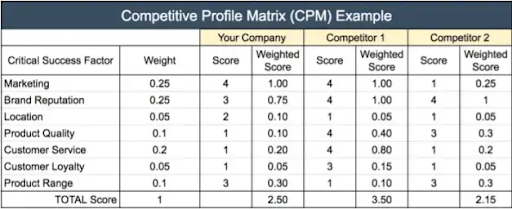

Competitive Profile Matrix (CPM): A Visual Tool for Competitive Analysis

A Competitive Profile Matrix (CPM) is a valuable tool for visually comparing the relative strengths and weaknesses of competitors. It helps organizations identify their strategic positioning and develop effective competitive strategies.

How to Create a CPM:

1. Identify Key Success Factors (KSFs):

Determine the critical factors that contribute to success in the industry. These factors might include product quality, brand reputation, distribution channels, pricing strategy, customer service, or innovation.

2. Select Competitors:

Choose the key competitors to be included in the analysis. Consider direct competitors, indirect competitors, and potential future entrants.

2. Rate Competitors on KSFs:

Assign numerical ratings to each competitor on each KSF, using a scale of 1 to 5 (or any other appropriate scale). A higher rating indicates a stronger competitive position.

3. Create the Matrix:

Construct a matrix with competitors listed vertically and KSFs listed horizontally. Fill in the matrix with the ratings assigned to each competitor on each KSF.

4. Analyze the Matrix:

Identify the strengths and weaknesses of each competitor.

Identify gaps in the market where there are opportunities for differentiation.

Identify areas where the company has a competitive advantage.

A CPM can help identify strategic positioning opportunities by:

Identifying Market Gaps: Look for areas where no competitor has a strong position. This could be an opportunity to enter a niche market or develop a new product or service.

Identifying Competitive Advantages: Identify areas where the company has a significant advantage over its competitors. This could be a basis for a differentiation strategy.

Identifying Areas for Improvement: Identify areas where the company is weaker than its competitors. This could be a focus for improvement or investment.

By using a CPM, businesses can gain a deeper understanding of their competitive landscape and make informed decisions to achieve sustainable growth.

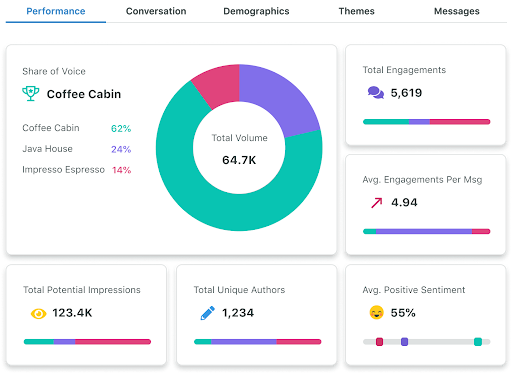

Harnessing the Power of Social Media Listening in Competitive Analysis

Did you know that about 77% of businesses use social media to reach their customers?

Social media has revolutionized the way businesses interact with their customers and monitor their competitors. You can access consumer sentiment, industry trends, and competitor activity through social media listening tools.

Key Social Media Listening Tools:

Brand24: This comprehensive tool allows you to track brand mentions, competitor activity, and industry news across various social media platforms.

Hootsuite: While primarily known for social media management, Hootsuite also offers powerful listening features to monitor keywords and hashtags.

Sprout Social: This all-in-one social media management and listening platform provides in-depth analytics, sentiment analysis, and competitor benchmarking.

Source: Sprout Social

How to Use These Tools

Set Up Alerts:

Create alerts for specific keywords, brands, or competitors to track relevant conversations.

Use Boolean operators (AND, OR, NOT) to refine your search queries.

Monitor Brand Mentions:

Track mentions of your brand to gauge customer sentiment and identify potential issues or opportunities.

Respond promptly to customer inquiries and feedback.

Analyze Competitor Activity:

Monitor your competitors' social media activity to understand their marketing strategies, messaging, and customer engagement.

Identify their strengths and weaknesses to inform your own strategies.

Identify Industry Trends:

Track industry-related hashtags and keywords to stay up-to-date on emerging trends and consumer preferences.

Use sentiment analysis to gauge public opinion on industry topics.

Gather Customer Insights:

Analyze customer feedback and reviews to identify areas for improvement and opportunities for innovation.

Use sentiment analysis to measure customer satisfaction and identify potential detractors.

If gaining a competitive edge is your goal, social listening tools are undeniably a critical asset. Use them to improve your marketing efforts and make data-driven decisions.

Ethical Web Scraping and Data Extraction

While web scraping can be a powerful tool for data collection, it's important to navigate the ethical and legal landscape carefully while using it for competitive analysis.

Ethical Considerations

Respect Website Terms of Service: Always adhere to the terms of service of the websites you're scraping. Some websites may prohibit automated data extraction.

Avoid Overloading Servers: Implement measures to limit the frequency and intensity of your scraping activities to avoid overwhelming the target website's servers.

Respect Privacy: Be mindful of privacy laws and regulations. Avoid collecting personally identifiable information (PII) without explicit consent.

Use Ethical Scraping Practices: Employ techniques that minimize the impact on the target website, such as using polite user-agent strings and respecting robots.txt directives.

Using Tools for Web Scraping

Scrapy: A powerful Python framework for large-scale web scraping. It allows you to create efficient and scalable spiders to extract data from websites.

Beautiful Soup: A Python library for parsing HTML and XML documents. It's great for smaller-scale scraping projects and extracting specific data from web pages.

Key Steps for Web Scraping:

Identify Target Websites: Determine the websites you want to scrape.

Analyze Website Structure: Inspect the HTML structure of the pages to identify the elements containing the desired data.

Write the Scraper: Use a tool like Scrapy or Beautiful Soup to write a script that extracts the necessary data.

Test and Refine: Thoroughly test your scraper to ensure it's working correctly and refine it as needed.

Store and Analyze Data: Store the extracted data in a suitable format (e.g., CSV, JSON) and analyze it to gain insights.

Customer Surveys and Interviews: A Deeper Dive

Customer surveys and interviews are invaluable tools for gathering firsthand insights into customer preferences, perceptions, and behaviors. By understanding your customers, you can gain a competitive edge and make informed business decisions.

Designing Effective Surveys:

Clear Objectives: Define the specific goals of your survey to guide question development.

Relevant Questions: Ask questions that directly address your research objectives.

Balanced Question Types: Use a mix of open-ended and closed-ended questions to gather both quantitative and qualitative data.

Pilot Testing: Conduct a small-scale pilot test to identify any issues with the survey design.

Incentivize Participation: Offer incentives to encourage a higher response rate.

Conducting Effective Interviews:

Develop an Interview Guide: Create a structured interview guide to ensure consistency and cover all relevant topics.

Establish Rapport: Build rapport with the interviewee to create a comfortable and open environment.

Active Listening: Pay close attention to the interviewee's responses and ask follow-up questions to gain deeper insights.

Avoid Leading Questions: Frame questions neutrally to avoid biasing the responses.

Take Detailed Notes: Record the interview or take detailed notes to accurately capture the information.

Web scraping and customer research techniques can help you understand your market, your competitors, and your customers. This knowledge will empower you to make informed decisions and achieve sustainable growth.

Advanced Competitive Intelligence Techniques

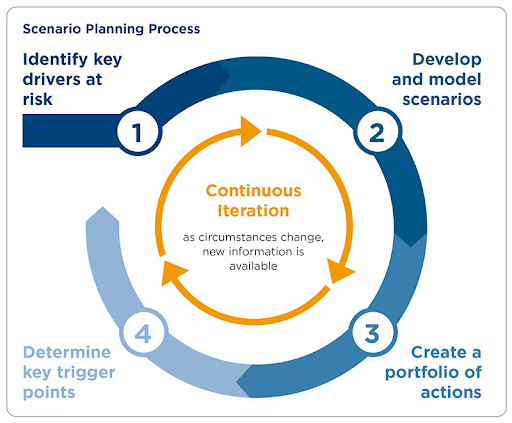

Scenario Planning

Scenario planning is a strategic foresight technique that involves creating multiple plausible future scenarios based on different assumptions about key drivers such as economic trends, technological advancements, and regulatory changes. By considering a range of potential futures, businesses can identify potential risks and opportunities, develop contingency plans, and make more informed strategic decisions.

Steps in Scenario Planning:

Identify Key Drivers: Determine the key factors that will shape the future of the industry.

Develop Scenarios: Create multiple scenarios, ranging from optimistic to pessimistic, based on different combinations of key driver outcomes.

Analyze Implications: Assess the potential impact of each scenario on the business, including opportunities, threats, and challenges.

Develop Strategies: Develop strategies that are robust enough to address a range of potential future outcomes.

War Gaming

War gaming is a strategic simulation technique used to test different strategic options against potential competitor moves. The idea is to simulate competitive interactions to identify vulnerabilities, strengths, and potential pitfalls in your strategies.

Key Steps in War Gaming:

Define the Scenario: Clearly outline the competitive situation and the objectives of the war game.

Develop the Game Board: Create a visual representation of the competitive landscape, including key players, markets, and resources.

Assign Roles: Assign roles to participants, including decision-makers, analysts, and competitors.

Play the Game: Simulate competitive interactions, making decisions and responding to the actions of other players.

Analyze the Results: Evaluate the outcomes of the war game to identify lessons learned, potential risks, and opportunities.

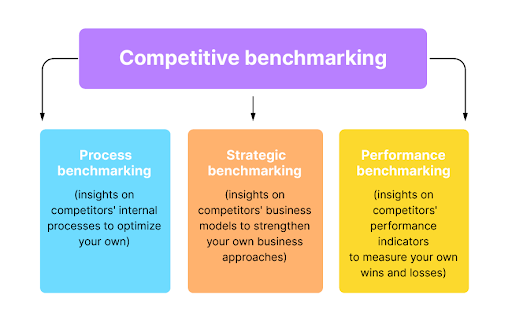

Competitive Benchmarking

Competitive benchmarking involves comparing your company's performance against industry best practices. Identifying areas where your company lags behind competitors can help you prioritize improvement efforts and close performance gaps.

Key Steps in Competitive Benchmarking:

Identify Key Performance Indicators (KPIs): Determine the key metrics that will be used to measure performance, such as customer satisfaction, market share, and profitability.

Select Benchmarking Partners: Identify companies that are recognized as industry leaders or that share similar characteristics with your company.

Collect Data: Gather data on the performance of your company and the benchmark companies.

Analyze the Data: Compare your company's performance to the benchmark companies to identify areas of strength and weakness.

Identify Improvement Opportunities: Identify specific areas where your company can improve its performance.

Implement Improvement Initiatives: Develop and implement action plans to address the identified gaps.

The Bottom Line

Competitive analysis is not a one-time thing. It’s an ongoing process. New competitors can appear without notice, old rivals can disappear at once, and the market demand can shift at any time.

When it comes to competitive analysis, don’t just analyze your competitors. Analyze your own brand regularly too. Accept your weaknesses, embrace your strengths, and take advantage of incoming opportunities.

Empower your company with the help of a competitive analysis, and take your product to new heights.

What is a Competitive Analysis?

A competitive analysis is a strategic tactic used to identify and evaluate competitors.

What is the purpose of a Competitive Analysis?

The purpose of a competitive analysis is to determine the competitor’s strengths and weaknesses relative to your own product.