The Fintech industry is skyrocketing right now. In fact, in 2022 alone, the Fintech market is estimated to have grown from $105.41 billion to $131.95 billion. So, what has prompted this surge? Why is Fintech making such a splash in the financial industry? The answer is simple. Fintech innovation.

Before the birth of Fintech, the financial industry was slow and lacked agility. Regulatory frameworks, legacy technologies, and archaic systems hindered the industry greatly.

But the rise of the Fintech sector has disrupted the finance industry, shedding the fat and creating an agile, stable, and innovative new way of doing finance.

This article looks at what’s on the horizon for Fintech innovation; the challenges, the latest technologies, and the impact on the industry.

The playing field

Context plays a huge role in understanding the past, present, and future of Fintech innovation. Since it burst onto the scene, there has been tension between banks and Fintech companies. And it’s hardly surprising.

Banks have long been known for their conservatism. Whereas Fintech companies are all about innovation. Banks are associated with being trustworthy and secure, while Fintech businesses pride themselves on their convenience and flexibility.

These fundamental differences have created a virtual battlefield between Fintech and banks.

Fintechs have become the driving force behind the innovation points we look at below, while banks tend to move slower. They copy what works and what’s been regulated.

Let’s take a look at some ways Fintech has revolutionized the way the world manages money.

Technology

The clue is in the name. Fintechs are all about harnessing technology to provide more convenient, innovative banking solutions.

Here are a few ways technology has shaped the financial world.

Artificial Intelligence (AI)

Once considered nothing more than a pipe dream, AI is now a crucial part of the financial industry. As it becomes more sophisticated, it is used in Fintech in the following ways:

scam prevention

better quality customer support in real-time

asset management

insurance

personalized financial advisory services

Blockchain

One of the most exciting technological advances of the 21st century, blockchain has changed the face of banking in a number of ways. Blockchain technology:

eliminates third parties

reduces operational time and costs

enhances the identity verification process

Let’s explore some of the most exciting blockchain projects in the Fintech sector.

Bakkt

Bakkt is made up of a number of digital asset management tools, including a payment system, digital wallet, crypto-exchange, and Bitcoin. It’s fully regulated by US laws and has recently partnered with Starbucks to give mobile app users the option to pay using the Bakkt digital wallet.

Bakkt is striving to make cryptocurrency a more common payment method.

Connext Network

Designed to streamline P2P blockchain transactions, Connext supports platforms in providing instant transfers between digital wallets and offering P2P micropayments. Using state channels, it allows users to gather their transactions into a single network transfer.

Connext is already being used in projects such as Mosendo, Provide, and Metamask.

Interbank Information Network

Developed by J.P Morgan, around 400 banks have already joined Interbank Information Network (INN). It’s a network based on blockchain technology that was designed to speed up the process of cross-border payments.

With INN, banks can exchange compliance-related data (name, date of birth, address, etc.) in real-time. Since the data is already on the blockchain, all parties involved in the compliance verification process have access to it without having to contact each other. As a result, the verification process has been reduced from several days to several minutes.

Cloud computing

The advent of cloud computing caused a stir in the financial world and beyond. With cloud computing, users can securely manage their data using logical access control.

Authenticated users have access to data whenever and wherever they need it. Businesses now leverage the vast potential of the cloud to securely store and manage data, especially for lending and payment apps. For example, they can use cloud-based development platforms like Wix to manage subscriptions and the financial data linked to said subscriptions.

Put simply, cloud computing gave Fintechs the power to securely store and manage data at scale, opening up the doors for a myriad of digital payment and lending apps.

Open source, SaaS, & serverless

The introduction of SaaS and serverless software has undoubtedly made its mark on the world of Fintech.

As we already mentioned, costly and clunky infrastructures and support systems were the main culprits behind slow banking.

Now, SaaS, open source, and serverless options save Fintechs time and money on infrastructure management and support. Because of this, they can launch new services faster and efficiently implement security best practices. Plus, customers now only pay for what they use.

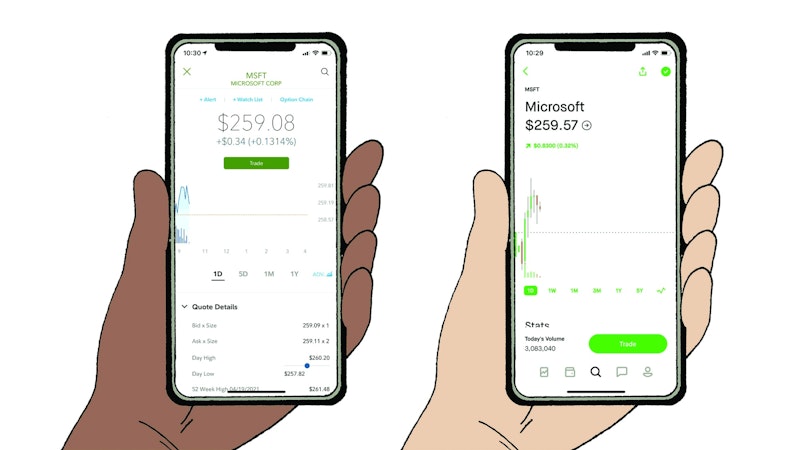

The know-how of UX

Gone are the days of being complacent about bad usability and mediocre or bland design. Platforms such as Robinhood and Klarna, for example, go beyond the minimum expectations, showing users what great UX should look like.

These leading Fintech tools have adopted modern and colorful branding elements, which contrasts with the way modern banks look. Users seem to resonate with these bright and modern design elements.

Speaking of bright, the future doesn’t look too bright for tools such as Bloomberg, which are notorious for bad usability. Millennials and GenZ are reported to value convenience above all else. So, Fintechs need to make sure they hit the mark when it comes to UX design.

With so many competitors on the market, users simply won’t tolerate sloppy design and bad usability any longer.

The advent of new Fintech models

Fintech innovation moves at breakneck speed, meaning new models burst onto the scenes all the time. We’ve rounded up a few of the big hitters.

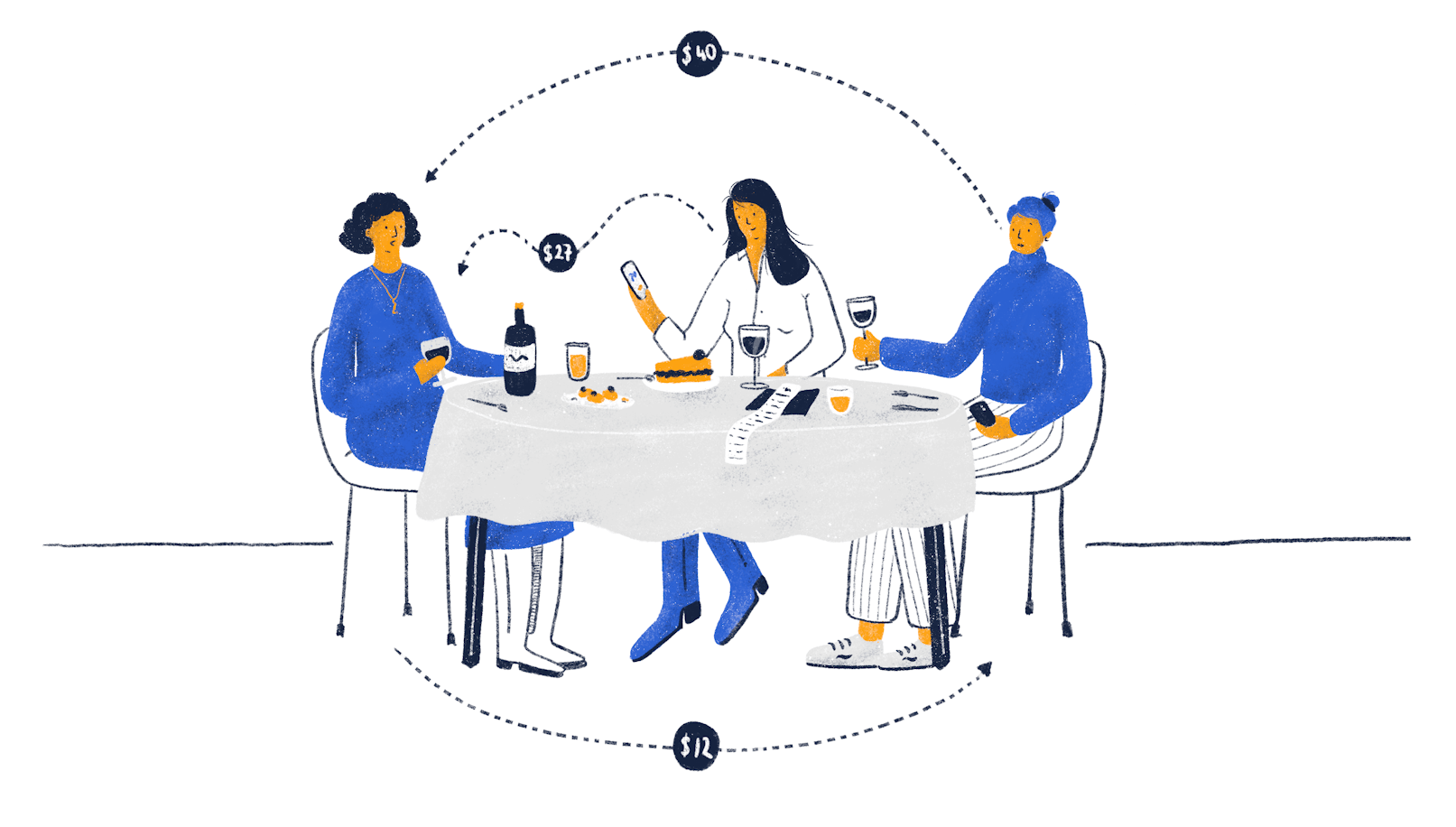

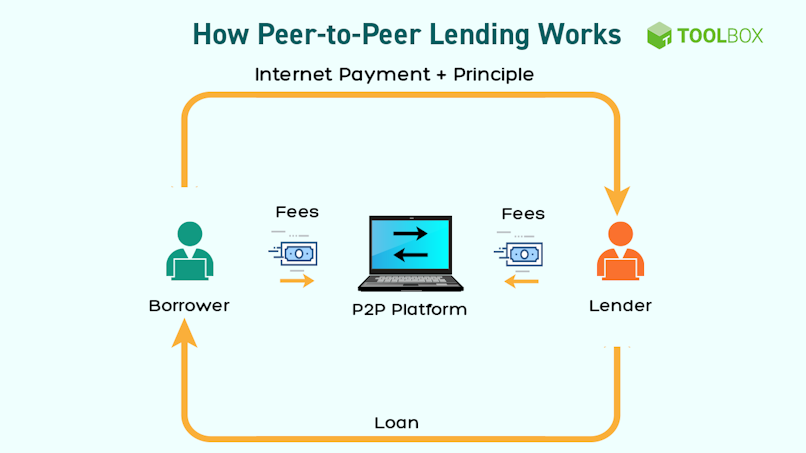

P2P lending

If you’re unfamiliar with the term, P2P (peer-to-peer) lending simply means lending or borrowing money without the need for a middleman.

P2P lenders are individual investors who want to get a better return on their cash savings than they would get from a bank savings account or certificate of deposit. On the other hand, P2P borrowers are looking for an alternative to traditional banks or a lower interest rate.

The default rates for P2P loans tend to be much higher than those in traditional finance.

Both PayPal and Google Pay offer P2P lending for registered users. PayPal charges a fee for its payment transaction. You can learn more about its fees using a PayPal fee calculator.

Digital wallets

Digital wallets differ from simply paying online because they allow the consumer to save payment information for later by adding a debit card to the app. When it’s time to pay, the user can do it straight from their app by holding their smartphone to a card reader without needing to remember or re-enter their payment credentials.

As the name suggests, they can accommodate anything a traditional wallet can – from resort passes to boarding cards, movie tickets to loyalty vouchers.

Google Pay, Apple Wallet, and Cash App are all examples of digital wallets.

Asset Management

Fintech applications have done wonders for the asset management industry. Firms can now collect and leverage significant amounts of data, analyzing it to better inform decision-making.

As the landscape gets increasingly more complex and the market increasingly crowded, asset managers also use these technologies to differentiate their service offerings.

Coinbase, Chime, and Money Lion are examples of Fintech companies using the latest Fintech innovation for asset management.

Digital banking

We’re all familiar with online banking. Since its adoption, users can now access digital banking services and features from their computers or phones.

Digital banking has grown in popularity among consumers, with an estimated 203 million people using digital banking services in 2022. And there are no signs of its popularity waning. That number is projected to reach a whopping 216.8 million by 2025.

Revolut, bunq, and n26 are some of the top players in digital banking today. From the comfort of your home, you can check everything from Edward Jones CD rates to your credit score, making digital banking incredibly convenient and a staple in the industry.

Future scenarios

So, what does the future hold for Fintech innovation?

The way we see it, there are 3 ways the banks and Fintechs (being the 2 leading Fintech players) can interact going forward.

It’s either banks win and Fintechs lose, vice versa, or something in between. Stick with us as we explore each of these possible outcomes.

The downfall of Banks

The first option is the demise of banks. In the future, banks will become obsolete, and Fintechs will take their pace. The reason for the downfall of brick-and-mortar banking is that Fintechs are more dynamic, convenient, and not so heavily bound by government regulations. As such, they have the agility to continue to disrupt and innovate in a way banks simply can’t.

In this scenario, banks will lose the competitive edge and, due to their overwhelmingly risk-averse approach to innovation, become completely out of touch with the new generation of customers.

Technology changes how customers’ behaviors and expectations. So, underutilizing innovation that is in line with these expectations has created a significant power vacuum that the most successful Fintech companies could fill.

Absorption of Fintechs by Banks

The second scenario sees banks absorbing Fintechs. In this option, banks will finally decide to move away from a risk-averse approach. They will start innovating and investing heavily in R&D in a meaningful and actionable way. In doing so, it would be virtually impossible for Fintechs and finance startups to compete.

Essentially, this outcome monopolizes banks. Banks will retake their throne as the dominant player in the finance industry.

The development of new technologies and services might also take the form of buyouts of fledgling companies that provide excellent value to the customers but still lack the resources to scale up properly.

As the need for convenience increases and the risk-averse approach within the banking business culture subsides, we could see an increase in the reliance on bank-led funding for innovation. Additionally, we could even see startups beginning to compete in order to secure investment opportunities from banks.

In turn, this will result in Fintech companies never reaching their full potential.

Synergy Scenario

The third scenario sees banks becoming the “back end” of financial infrastructure, disappearing in all but name from the social sphere.

In this world, ATMs and other convenience institutions will remain, but the “front” of the finance industry will be delegated to Fintechs, which will work as the service providers to all users.

This is a prime opportunity to foster understanding between users, banks, and Fintechs. It’s also a chance to capitalize on the great strengths of emerging technologies and API integrations across different services and platforms.

With UX being on point when improving and substituting for new, updated technologies, the industry could achieve unprecedented success.

But how?

Since competition and disruption would be minimized, this creates space for new partnerships that provide users with faster, more aligned, and lower-risk services.

Bottom line

Fintech innovation has soared, making it one of the fastest-growing and most dynamic markets in the world. Advanced technology and UX design have earned Fintech the reputation of being a quick and convenient alternative to traditional banking. From blockchain to SaaS, Fintech has been able to evolve at an unprecedented speed.

So, what does the future hold for Fintech innovation? That depends. While there are 3 likely scenarios, the only thing we can really be sure of is that change is always on the horizon in the Fintech sector.